Things like public services, roads and buildings etc are all funded by the government. Government Spending - the government can't just tax us and keep all the money, otherwise why would we pay tax? The government uses the taxation money that receive from us, and they spend money on keeping the country running. Capital goods are goods that firms need to make output.Įxports - some of the money that enters our circular flow is from other countries. Investment - some of this money is invested by firms towards the purchase of capital goods, for example. It is money that enters our circular flow of income. Every country with a government will have a tax law which citizens have to follow.ĭo you notice the bright green lines in the diagram? These are our injections. Taxes - some of the money is taxed and transferred to the government. Do you see on the diagram how we give money to other countries and it enters their circular flow of income. Imports - some of the money is transferred between our circular flow and another country's. They hold back some of their income for future emergencies or future purchases. Saving - some of the money is saved by households. This is the money that exits our circular flow. We have governments we pay taxes to, other countries that we buying imports from and we also do not spend all of our money.ĭo you notice the red lines in the diagram? These red lines are our leakages or withdrawals. The above model is a more realistic view of our income. We need firms to be making more output so we need more expenditure and income etc. This proves the condition above is true and shows what we need for economic growth to occur. And if the firms make extra outputs, they must hire extra inputs and pay extra income. How can we show economic growth using this condition?Īny extra money spent will be reflected by extra output that the firms make. There are no purchases of imports or exports.įrom the diagram above we can also see the following condition is true:

It assumes a few things:Ģ) The market is a closed economy. This is shown as the flow of income between firms and households on the diagram. These factor inputs are land, labour and capital.Ĥ) The firms must pay the factor rewards to the factors of production. The more expenditure they receive, the more outputs they will produce.ģ) Firms produce these outputs by hiring factor inputs.

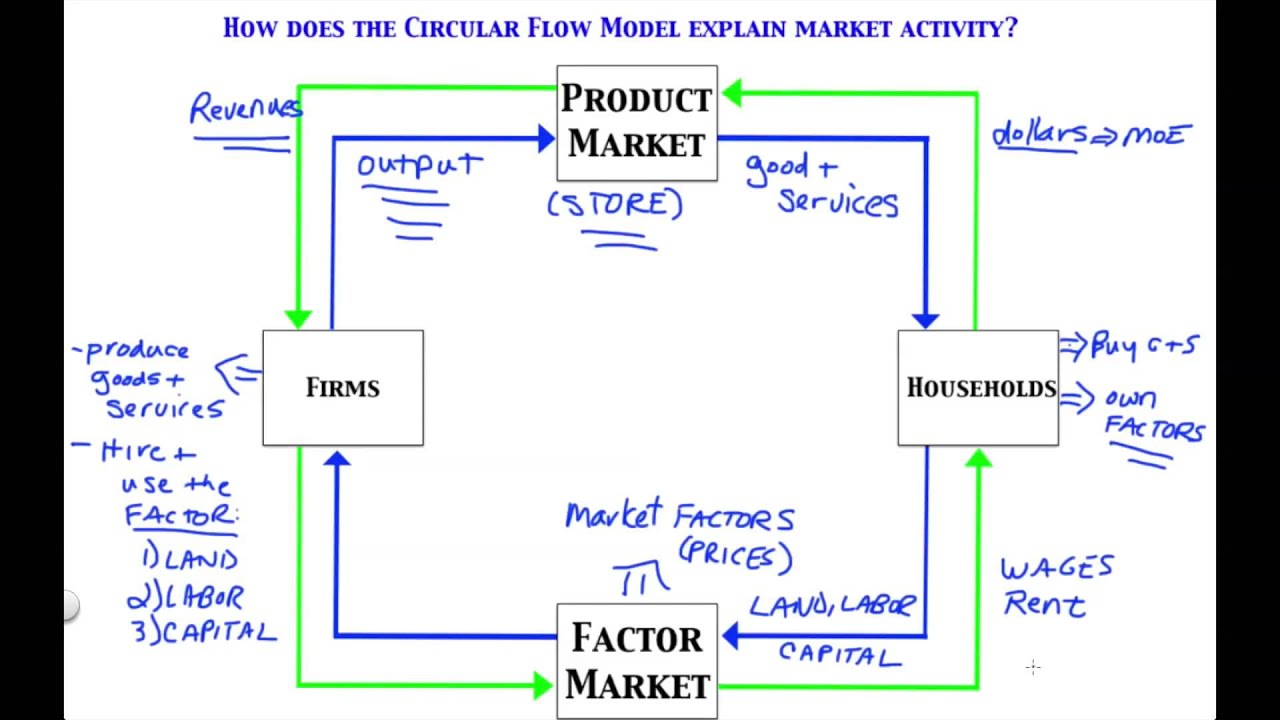

This is called expenditure.Ģ) Firms respond to the expenditure by producing outputs. The complete circular flow has five sectors: a household sector, a firm sector, a government sector, a foreign sector, and a financial sector.The diagram above shows the most basic circular flow of income model.ġ) Money flows from households to firms on the right hand side. The circular flow and measurement of GDP. GDP Opens in new window can be represented by the circular flow diagram as a flow of income going in one direction and expenditures on goods, services, and resources going in the opposite direction. Trade-Offs in Using Multiple Account System.Small Differences in Growth Rates Matter Measure of Economic Wellbeing.Alternative Measure of Economic Wellbeing.Centrally Planned Economies vs Market Economies.Trade-Offs: The What, How, and Who Questions.The Philips Curve: Tradeoff between Inflation & Unemployment.The People's Bank of China's Role in China's Monetary Policy.Meaning of Finance & Financial Structures.The Effects of Business Cycle on Inflation & Unemployment Rate.Strategies for Increasing Customer Value.

Management Accountants in Organizations.Trade-Offs in Using Accounting for Multiple Purposes.Epistemology: Human's Capacity to Retain Knowledge.Interdependencies in Multi-Value System.How Fiscal Policy Influences Aggregate Demand.The Liquidity Preference Theory's Implications for Aggregate Demand.The Influence of Monetary and Fiscal Policy on Aggregate Demand.Why the Short-Run Aggregate-Supply Curve Might Shift.Why the Aggregate-Supply Curve Slopes Upward in the Short Run.Why the Aggregate-Supply Curve Might Shift.Why the Aggregate-Demand Curve Might Shift.Explanations for Short-Run Economic Fluctuations.Three Key Facts About Economic Fluctuations.Education's Importance to Economic Growth.Small Differences in Growth Rates Matter.Economic Growth Rate & Formula to Calculate It.How Else Can We Measure Economic Wellbeing?.Shortcomings in GDP as a Measure of Wellbeing.Shortcomings in GDP as a Measure of Total Production.Forming and Testing Hypothesis in Economic Models.Story of the Market System in Action: I, Pencil.Centrally Planned Economies versus Market Economies.The What, How, and Who Economic Questions.

0 kommentar(er)

0 kommentar(er)